Pradhan Mantri Jan Dhan Yojana Online Application | Jan Dhan Yojana Account Opening From Online

Pradhan Mantri Jan Dhan Yojana (PMJDY) / प्रधान मंत्री जन धन योजना : The Prime Minister of India, Mr. Narendra Modi launched the scheme just after few months of coming to power in May 2014. It is also called Prime Minister’s People Money Scheme. It is a National Mission for Financial inclusion to ensure access to financial services, namely Banking Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner. The scheme was announced by prime minister on 15 August and launched on 28 August 2014. The scheme is headed by ministry of finance.

Pradhan Mantri Jan Dhan Yojana (प्रधान मंत्री जन धन योजना)

Pradhan Mantri Jan Dhan Yojana (PMJDY) / प्रधान मंत्री जन धन योजना is National Mission for Financial Inclusion to ensure access to finacial service, namely a basic saving & deposit accounts, remittance credit, insurance, pension in an affordable manner.

Under the PMJDY scheme, a saving deposit account can be opened in any bank branch or business correspondent (Bank Mitra) outlet. Bank accounts under PM Jan Dhan Yojana can be opened with zero balance. However, if the account holder wishes to get a cheque book, he/she will have to fulfill minimum balance criteria.

The PMJDY scheme launched with the target to enroll bank account of around 7.5 million households. In this regard, the Prime Minster personally mailed to Chairpersons of all PSU banks in which he categorically declared that a bank account for each household was a “national priority”.

The PM Jan Dhan Yojana started with the target to provide easy access of banking facilities starting with “Basic Bank Account” with overdraft facility of Rs. 5,000. After six months, Rupay Debit Card with inbuild accidental insurance cover of Rs. 1 lakh and Rupay Kisan Card and in the next phase, micro insurance & pension facility will also be added to the accounts.

- Account holders will be provided zero-balance bank account with RuPay debit card, in addition to accidental insurance cover of Rs. 1 lakh (to be given by ‘HDFC Ergo’).

- After Six months of opening of the bank account, holders can avail Rs. 5,000 overdraft from the bank.

- With the introduction of new technology introduced by National Payments Corporation of India (NPCI), a person can transfer funds, check balance through a normal phone which was earlier limited only to smart phones.

- Mobile banking for the poor would be available through National Unified USSD Platform (NUUP) for which all banks and mobile companies have come together.

Also Read: Sarkari Yojana

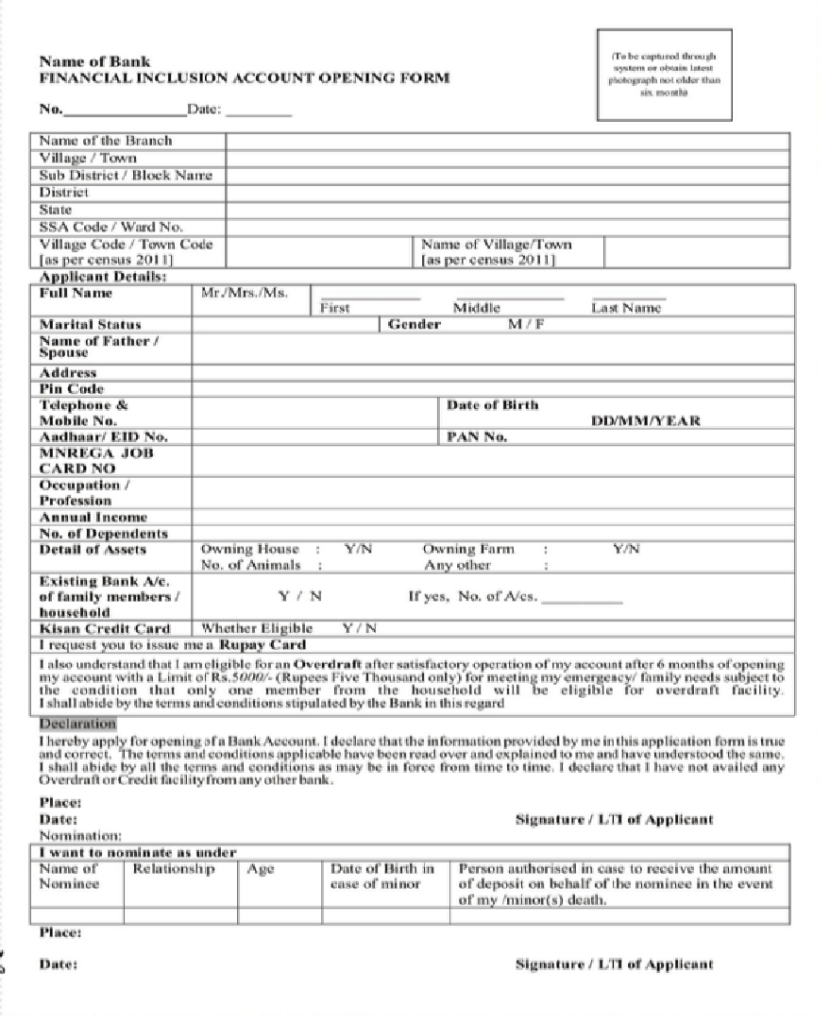

Jan Dhan Yojana Application Form PDF

Pradhan Mantri Jan Dhan Yojana application Form can be downloaded from below link in PDF format. The application form of Jan Dhan Yojana is given below:

Jan Dhan Application Form English

Jan Dhan Application Form Hindi

How to Open Jan Dhan Yojana Account

There are the following step to open an account under Pradhan Mantri Jan Dhan Yojana:

Step-1: Documents

Applicant should have documents which are permissible as eligibility proof.

Step-2: PM Jan Dhan Application Form

Applicant can obtain the Pradhan Mantri Jan Dhan Yojana form from the official website of PMJDY or any other bank website as well.

Step-3: KYC Details

Fill up with the form and attach proof document like ID proof, address and also fill this form with full details of KYC.

Step-4 Submit Jan Dhan Yojana Form to nearby Bank Branch

Submit the Pradhan Mantri Jan Dhan Yojana application form along with all document to a nearby bank branch where you want to open Jan Dhan Account.

Step-5 Verification

After proper verification of the all documents, your Jan Dhan Bank Account will be opened.

Eligibility for Jan Dhan Yojana

There are following eligibility criteria to open a Basic Saving Deposit Account (BSBDA) with zero balance under Pradhan Mantri Jan Dhan Yojana

- Applicant should be a citizen of India

- Applicant age should be 10 year and above

- Applicant does not have bank account

Documents required to open an account under Pradhan Mantri Jan-Dhan Yojana:

- If the applicant have Aadhar card/Aadhar Number then no other documents is required to open account under the scheme. If the applicant has changed address, then a self-certification of current address is sufficient.

- If Aadhaar Card is not available, then any one of the following Officially Valid Documents (OVD) is required: Voter ID Card, Driving License, PAN Card, Passport & NREGA Card. If these documents also contain your address, it can serve both as Proof of Identity and Address.

- If a person does not have any of the officially valid documents mentioned above, but it is categorized as low risk’ by the banks, then he/she can open a bank account by submitting any one of the following documents:

- Identity Card with applicant’s photograph issued by Central/State Government Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks and Public Financial Institutions;

- Letter issued by a gazette officer, with a duly attested photograph of the person.

Jan Dhan Yojana Achievements

Guinness World Records Recognizes the Achievements made under Pradhan Mantri Jan Dhan Yojana (PMJDY). According to the report, around 1.5 crore (15 million) bank accounts were opened under this scheme. The report says that number accounts were opened in first week as a part of financial inclusion campaign is 18,096,130. By 13 January 2016, over 20 crore (200 Million) bank accounts were opened and around Rs. 301.08 billion were deposited to bank accounts under the scheme.

Special Benefits under Pradhan Mantri Jan Dhan Yojana Scheme

- Zero-balance account and Rupay debit card will be provided to account holders.

- Interest on deposit.

- Accidental insurance cover of Rs.1.00 lac.

- Life insurance cover of Rs.30,000/-.

- Easy Transfer of money across India.

- Beneficiaries of Government Schemes will get Direct Benefit Transfer in these accounts.

- After satisfactory operation of the account for 6 months, an overdraft facility will be permitted.

- Access to Pension, insurance products.

- Accidental Insurance Cover, RuPay Debit Card must be used at least once in 45 days.

- Overdraft facility upto Rs. 5000/- is available in only one account per household, preferably lady of the household.

Jan Dhan Yojana Helpline

In case of any queries related to the Pradhan Manti Jan Dhan Yojana, contact to PMJDY National Toll Free Number : 1800110001, 18001801111

Official Website to Access Details and Report of Pradhan Mantri Jan Dhan Yojana (PMJDY): http://www.pmjdy.gov.in/