Sukanya Samriddhi Yojana 2024 | Sukanya Samriddhi Account | Sukanya Samriddhi Yojana Interest Rate 2024 | Sukanya Samriddhi Yojana Calculator Chart | Sukanya Samriddhi Yojana Application Form PDF

Sukanya Samriddhi Account/Sukanya Samriddhi Yojana is a sterling initiative of Government of India for the parents to meet the expense of the Girl child’s higher education and marriage. The Sukanya Samriddhi Yojana was launched by Prime Minister Mr. Narendra Modi on 21 January 2015. The scheme is launched under the campaign of “Beti Bachao Beti Badhao”. The main purpose of Sukanya Samriddhi Yojana is to promote the welfare of every girl child.

Opening of Sukanya Samriddhi Yojana Account:

- The account under the scheme can be opened by the natural/legal guardian of girl child till she attains the age of 10 years.

- Only one account can be opened in the name of one Girl Child.

- The Guardian is allowed to open maximum two accounts in the name of two different Girl children.

- Maximum three accounts can be opened by the single guardian in case of twin girls as second birth or if the first birth itself results in three girl children.

Documents Required to Open Sukanya Samriddhi Account:

- Birth Certificate of Girl child.

- Proof of Address of parents/guardians.

- Proof of identity of the parents/guardian.

- Certificate or Medical Proof of Twin Girls from competent medical authorities.

Deposit in Sukanya Samriddhi Account

The initial minimum deposit for SSA/SSY is Rs. 1000/-, thereafter, any amount in the multiple of Rs. 100/- like Rs. 200/-, Rs. 300/-, Rs. 400/- etc can be deposited. In a financial year, minimum amount of Rs. 1000/- must be added to the account. Maximum Rs. 1,50,000/- can be deposited in one financial year.

The amount can be submitted in SSA/SSY accounts by cash or in the shape of cheque or demand draft.

Penalty under Sukanya Samriddhi Account:

If minimum Rs 1000/- is not deposited in a financial year, account will become discontinued and can be revived with a penalty of Rs 50/- per year with minimum amount required for deposit for that year.

Rate of Interest under Sukanya Samriddhi Yojana:

- For this year 9.2% p.a, yearly compounded.

- Every year, Government of India will announce the ROI (Rate of Interest) applicable for that financial year.

- Interest calculation method is similar to that of PPF.

Withdrawal under the scheme:

No Premature Withdrawal is permitted under Sukanya Samriddhi Yojana. However, maximum up to 50% of deposit amount can be withdrawn for marriage or higher education of girl child, once she reaches 18 years of age.

Operation of the account:

The SSA/SSY account will be opened and operated by the guardian of a girl child till the girl child attains the age of 10 years. After attaining the age of 10 year, the girl child may herself operate the account.

Transferring of SSA/SSY: The account may be transferred anywhere in India if the girl child in whose name the account stands shifts to a place other than the city or locality where the account stands.

Tax Rebate: As applicable under section 80C of the IT Act, 1961.

Closure on Maturity:

- The Sukanya Samriddhi Account shall mature on the completion of 21 year from the date of opening of the account: Provided that where the marriage of the account holder takes place before completion of such period of twenty-one years, the operation of the account shall not be permitted beyond the date of her marriage: Provided further that where the account is closed under the first proviso, the account holder shall have to give an affidavit to the effect that she is not less than eighteen years of age as on the date of closing of account.

- On maturity, the balance including interest outstanding in the account shall be payable to the account holder on production of withdrawal slip along with the pass book.

- If the account is not closed in accordance with the provisions of sub-rule (1), interest as per the provisions of rule 7 shall be payable on the balance in the account till final closure of the account.

NOTE: As this is a Govt. of India scheme, customers are advised to visit www.nsiindia.gov.in for latest instructions/ modification in the scheme. www.indiapost.gov.in/SukanyaSamriddhi.aspx

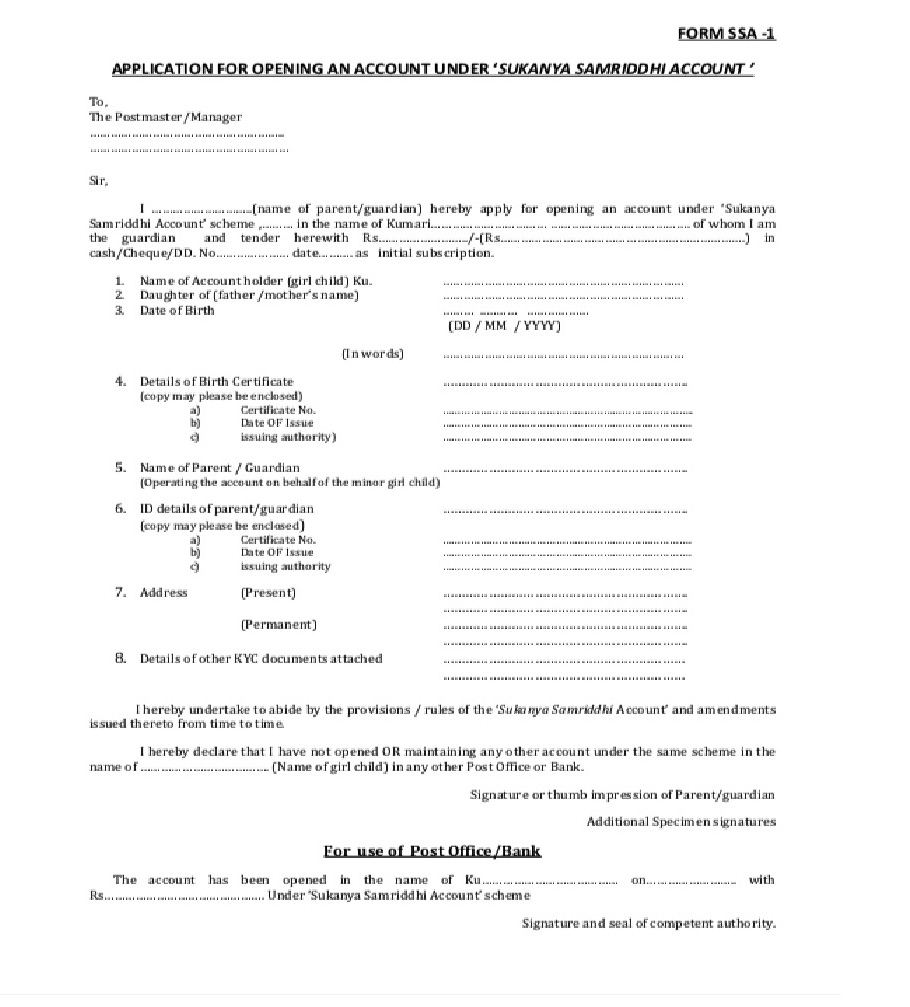

Sukanya Samriddhi Yojana Application Form PDF

Sukanya Samriddhi Yojana application form in PDF format can be downloaded from below link

https://rbidocs.rbi.org.in/rdocs/content/pdfs/494SSAC110315_A3.pdf

Sukanya Samriddhi Yojana Calculator

Sukanya Samriddhi Yojana calculator determine the amount of money the individual will receive on Maturity. check the Calculator from below link.

https://v1.hdfcbank.com/ssy-calculator/index.html

Read : Atal Pension Yojana (APY) Application Form PDF 2021 / Calculator / Enrollment Eligibility

nice